Self build mortgage calculator how much can i borrow

The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. In general obtaining a mortgage when youre self-employed can be more challenging.

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Find out how much you could borrow for a mortgage.

. A second mortgage is simply using an existing mortgaged property to borrow money from a financial institution says Jim Houston managing director of consumer lending and automotive finance. This is called an affordability assessment. Of course this depends on both parties circumstances and the addition of an applicant with very little or no income.

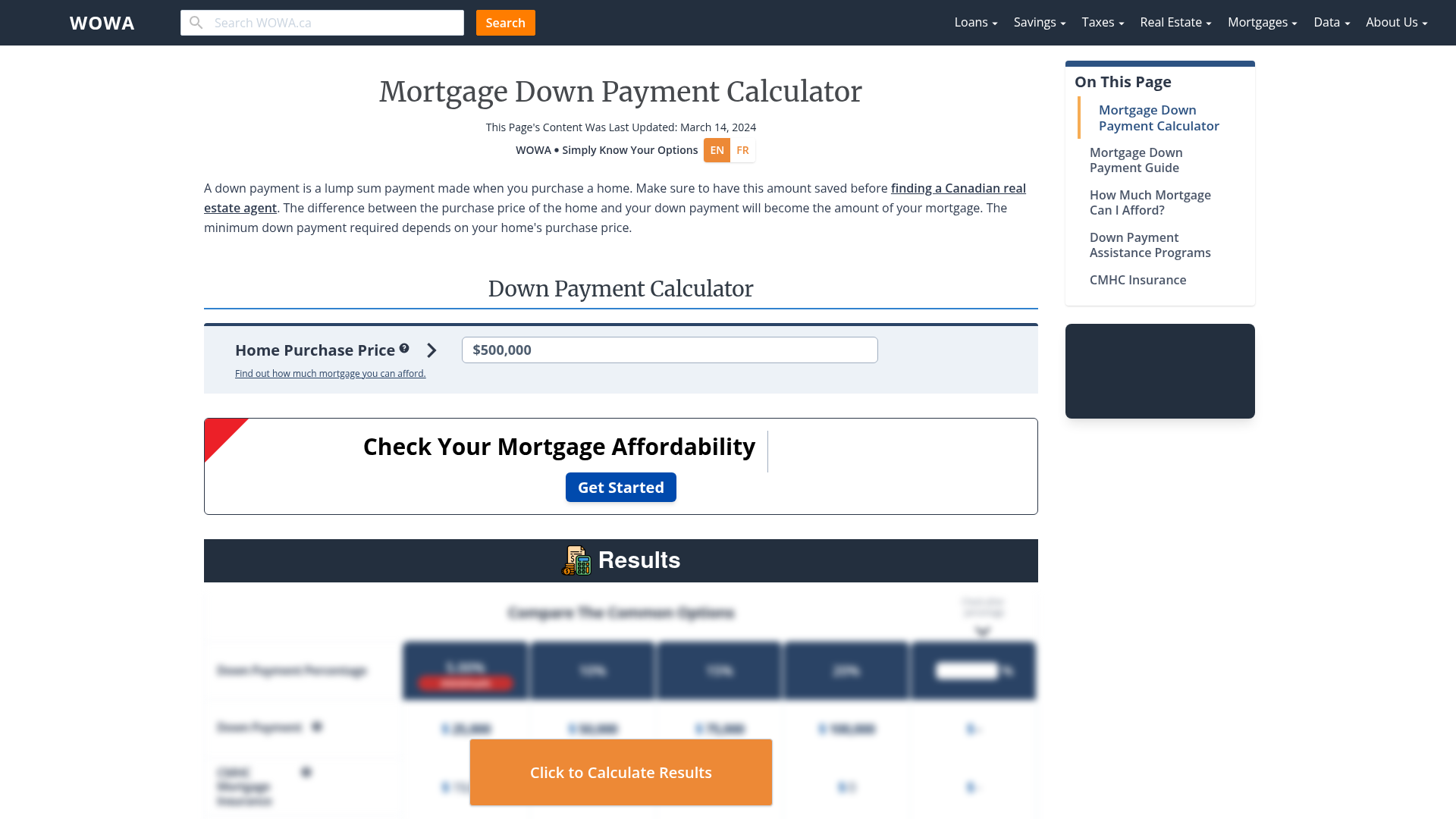

How much can you borrow. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc. The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a.

There are many reasons you may want to give a cash gift to your loved ones. The loan is secured on the borrowers property through a process. Our UK mortgage repayment calculator gives you an estimate of what your monthly mortgage payments might be based on the interest rate so you can calculate how much mortgage you can afford.

As you can see from the results how much house you can afford really depends on the relationship between your income and the mortgage. You can calculate your mortgage qualification based on income purchase price or total monthly payment. See the example below.

How to Calculate a Down Payment Amount. Or 4 times your joint income if youre applying for a mortgage. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.

Find out what you can borrow. First simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years however more lenders are now happy to offer mortgages over periods of up to. Buy-to-let mortgages are different.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Use our mortgage loan calculator to work out how much you might need to borrow and what deposit you need. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to.

And keep them in. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what your monthly mortgage payments could be in under 5 minutes. Enter the amount you want to borrow the interest rate and select one of the mortgage types to find out how much you will have to repay each month.

Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan. Her Majesty Queen Elizabeth II 21 April 1926 8 September 2022. It could be to help pay for a wedding a new car or university fees or to help give the younger generation a leg-up onto the property ladderOthers want to gift cash to reduce the value of their estate for inheritance tax IHT purposes with cash gift tax often being far less than the 40.

Use our MoneyHelper mortgage affordability calculator to find out how much you can afford to borrow for your new house. Unlike a mortgage for a house purchase self build borrowing isnt limited by your plot or propertys current value comments Emma Lunn. Getting a mortgage as a self-employed person neednt be a struggle as long as you can provide proof of your income for the last two full tax years.

An AIP is a personalised indication of how much you could borrow. You need to prove you have a reliable income source. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income.

Help to Buy is a UK Government initiative to help people buy a new build property. PMI typically costs between 05 to 1 of the entire loan amount. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own. No but we do have a buy-to-let mortgage calculator you can use instead. It will not impact your credit score and takes less than 10 minutes.

This type of self build mortgage is well suited to projects where much of the build is done off-site structural timber and oak frame houses for example. Where a friend or family member agrees to meet your monthly repayments if you cant. Use our Mortgage Affordability Calculator to estimate how much you can borrow.

Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20. You can typically. In a few exceptional cases you might be able to borrow as much as 6 times your annual income.

Now the shorter 15-year term will make Tom and Pattys monthly payment go up from 1150 to about 1300 per month and itll make yours go up a little too. They must also assess the monthly payment you can afford after looking at your outgoings as well as your income. BuildStore currently has 12 building societies offering cost-based products providing up to 95 of project costs and up to 85 of the final property value on sums from 50000 to 1m.

For further info. The mortgage calculator result helps Tom and Patty do two things. This calculator only shows you how much you could borrow to buy a property youll live in yourself.

The amount you can borrow will depend on your unique financial circumstances your income and outgoings and any outstanding debts will be used to establish how much you can borrow. Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. To figure out how much mortgage you can afford with your income housing lenders use different guidelinesbut most lenders dish out mortgages that are way more than people can afford.

Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. Lets presume you and your spouse have a combined total annual salary of 102200. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

How much mortgage can you borrow on your salary. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you. You can use the above calculator to estimate how much you can borrow based on your salary.

In a buy-to-let mortgage the lender wont work out how much you can afford to borrow based on your income and expenses. You can also input your spouses income if you intend to obtain a joint application for the mortgage. First they can see how much their new mortgage payment is.

Can I Get A Home Loan With No Deposit The Borrowers Home Loans Mortgage Companies

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Pin On House Design

Daisy Raouph I Mortgage Broker I The New Entrepreneur 6 Home Based Business Oppor Home Based Business Home Based Business Opportunities Business Opportunities

Ysn2nqnb0 Gom

Why Whole Life Insurance Is Usually Not A Good Investment And What To Do If You Have Already Bought A Whole Life Insurance Life Insurance Life Insurance Policy

Mortgage Affordability Calculator Rbc Royal Bank

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

How To Negotiate A Car Lease Get The Best Deal The Ultimate Guide Car Lease Car Buying Car Buying Tips

Mortgage Broker Estate Planning Mortgage Brokers Commercial Insurance

Jayson Bates On Twitter Reverse Mortgage Estate Lawyer Real Estate Investing

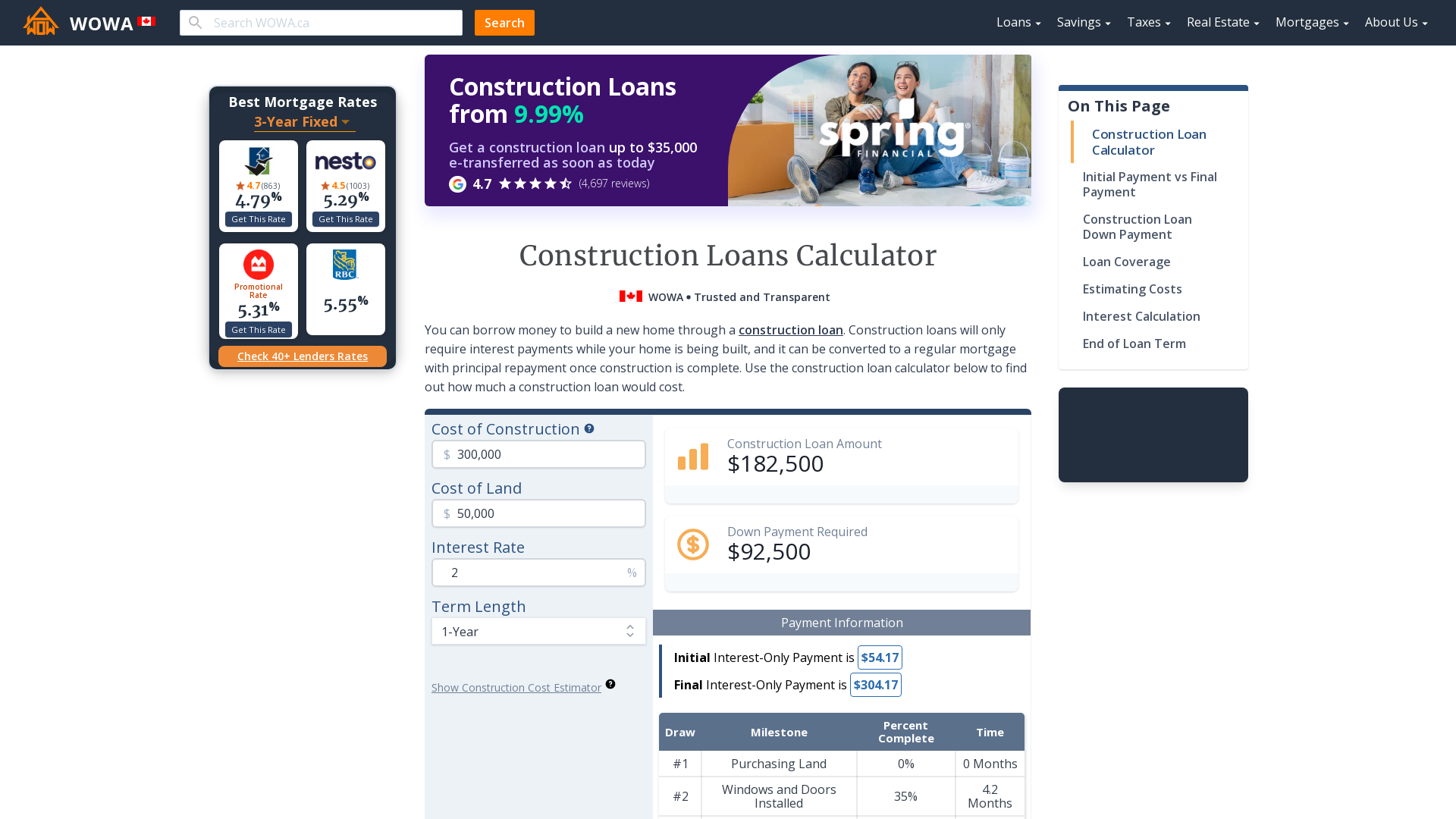

Construction Loan Calculator For Canadian Builders Wowa Ca

Guide To Getting A Mortgage In 4 Steps Meridian Credit Union

Do You Want To Improve Your Cibil Score In India Here Are Some Important Tips That Helps You T Improve Your Credit Score Loans For Poor Credit Unsecured Loans

Mortgage Demand Falls Even Further As Rates Shoot Back Up To July Highs In 2022 Mortgage Mortgage Banker Mortgage Rates

What Is An Assumable Mortgage Zillow Mortgage Rates Finance Saving Current Mortgage Rates

Daisy Raouph I Mortgage Broker I The New Entrepreneur 6 Home Based Business Oppor Home Based Business Home Based Business Opportunities Business Opportunities